Operational risk management framework. Download Scientific Diagram

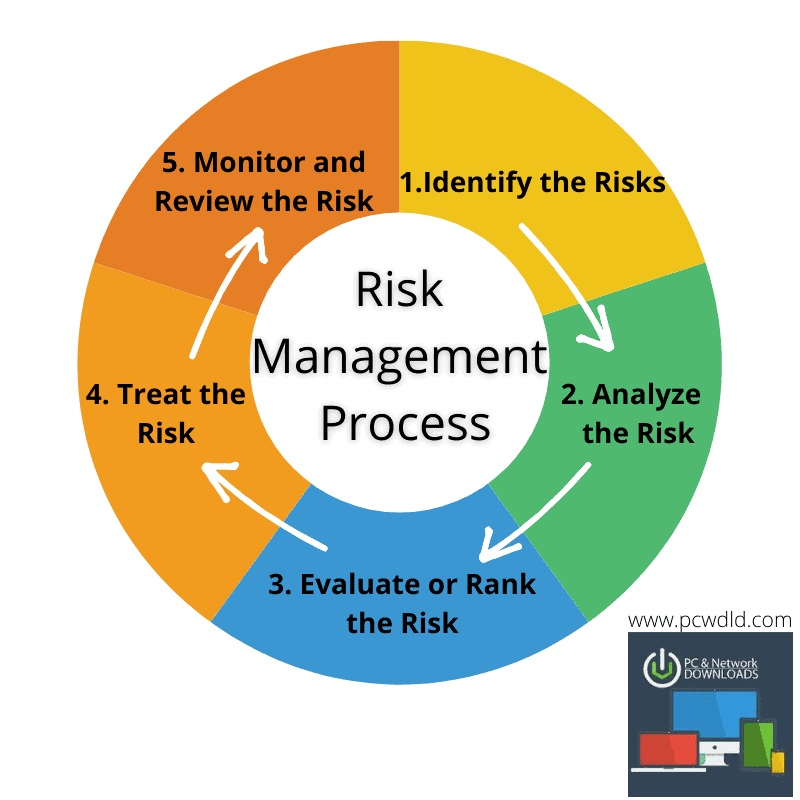

This step is where business managers identify, own, and manage operational risks and the controls that mitigate the identified risks. Risk identification should include triggers that institutions use to identify potential control failures that may result in operational losses.

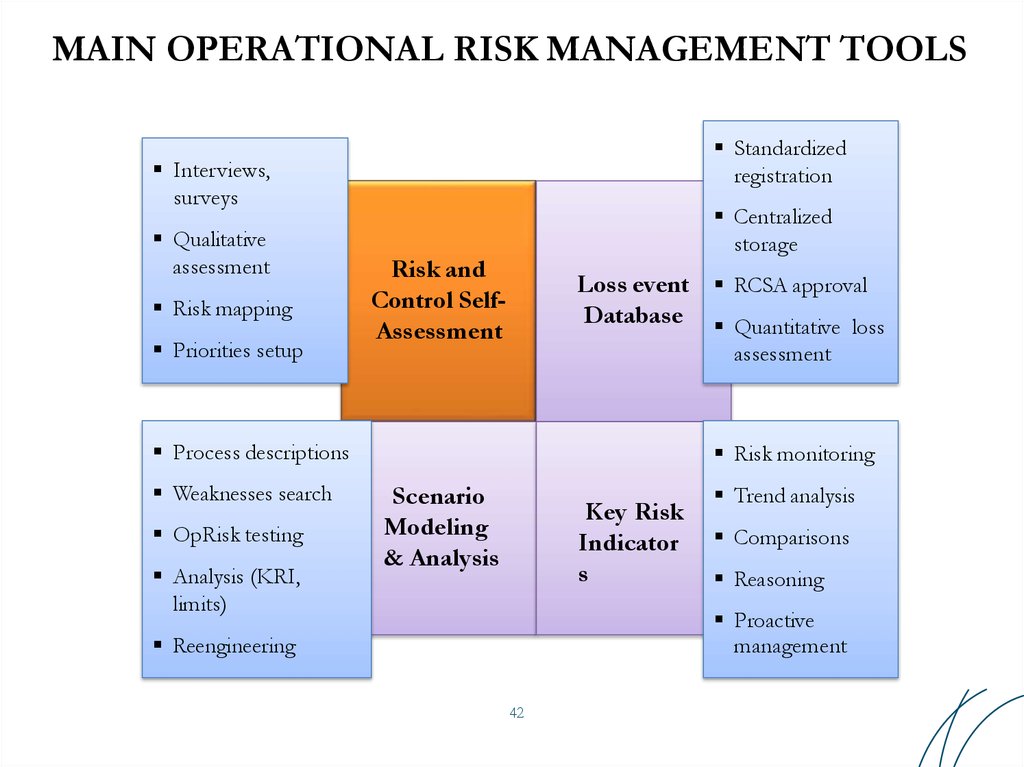

Operational Risk Management Best Practice Overview and Implementation online presentation

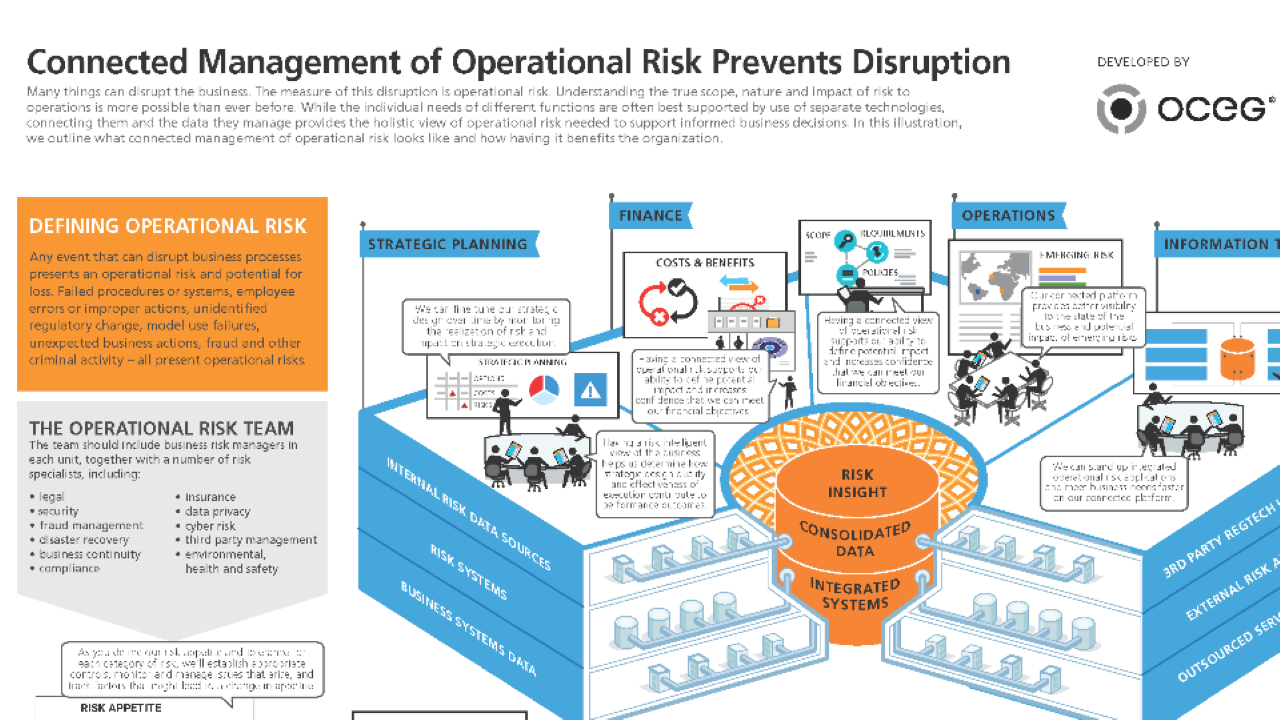

Our ORM framework can help you meet the challenge. Empowering informed business decisions The value proposition for strong operational risk management (ORM) is the effective management of operational risks that are inherent in the delivery of the business strategy.

Risk Management Framework And Why It Matters In Business FourWeekMBA

Get free Smartsheet templates By Andy Marker | October 21, 2020 (updated September 16, 2021) We've compiled expert tips and resources for implementing enterprise risk management, including best practices and advice on how to overcome common implementation challenges.

Risk management Failed Us! Explaining Security

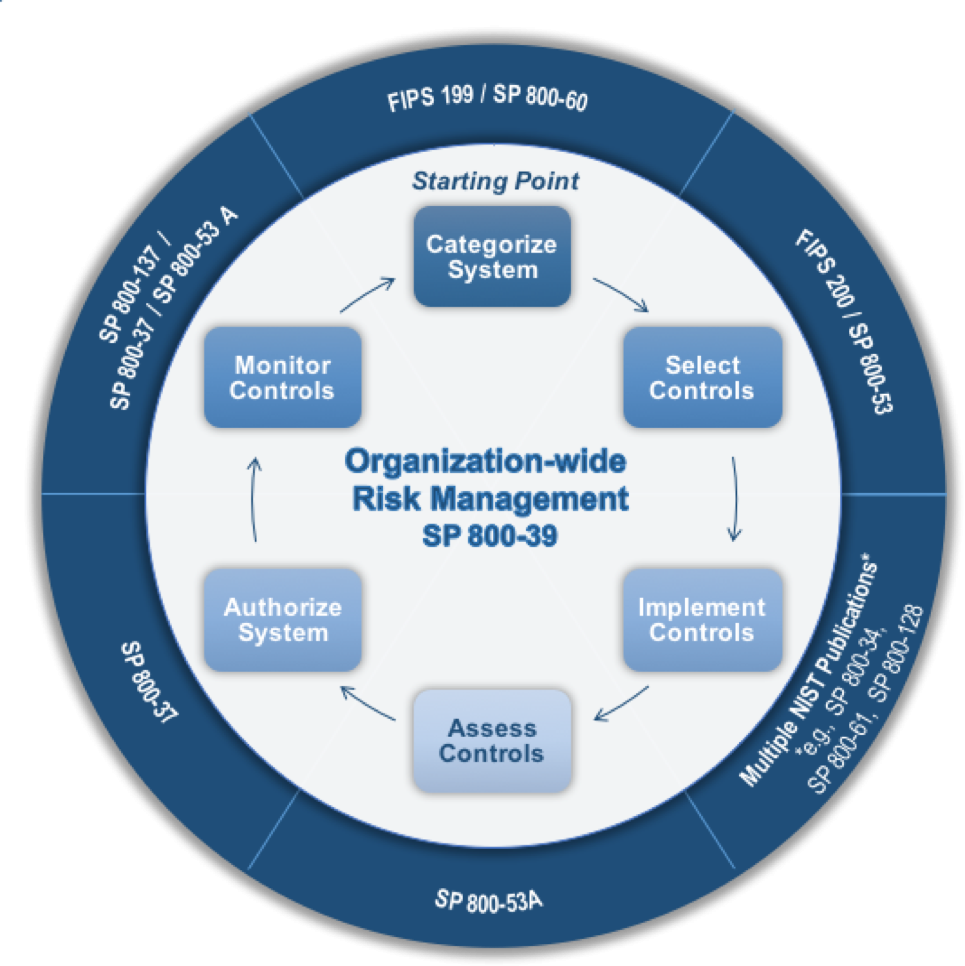

Use this risk management checklist to guide you through the following stages of establishing your risk management framework, as per the ISO 31000 risk management standard. This checklist document includes the following sections on effective risk management: Plan the Establishment of Your ISO 31000 Risk Management Framework

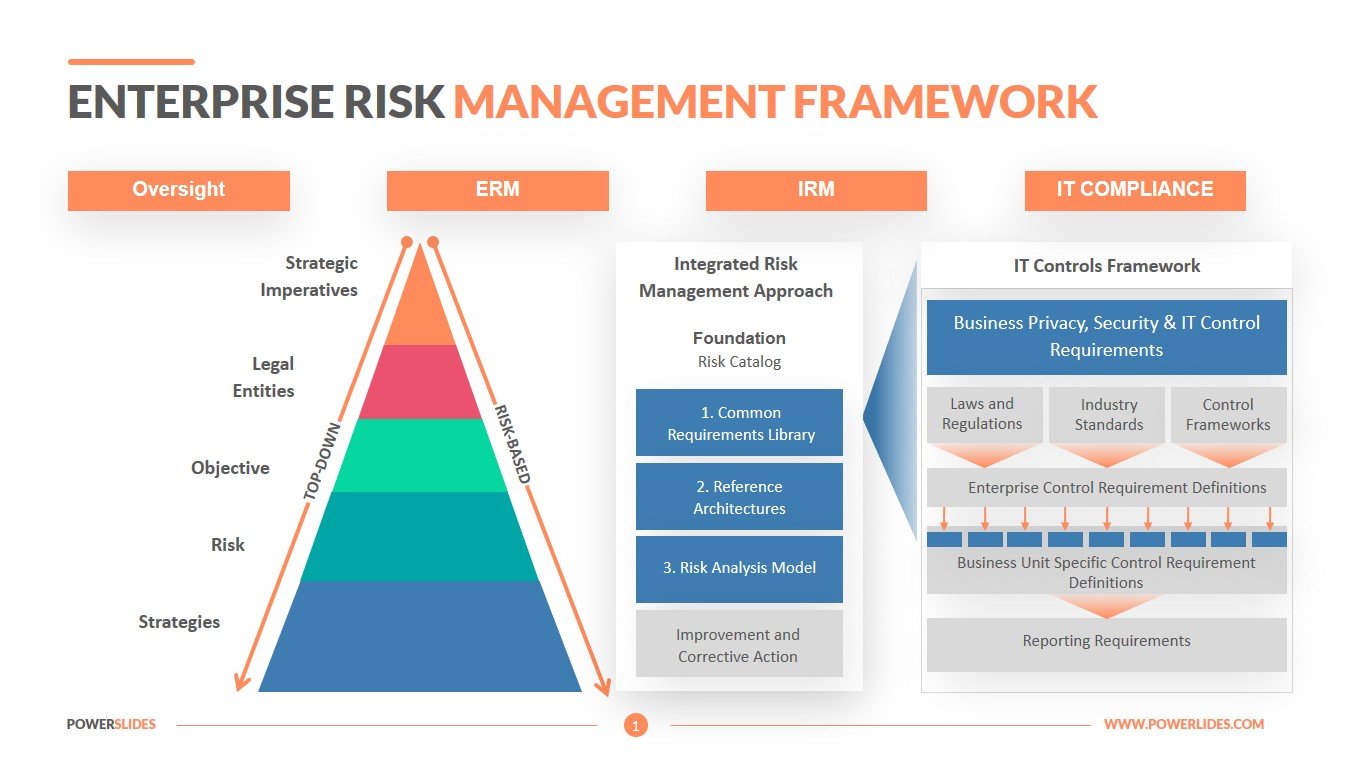

The Why and How of Integrated Risk Management

Operational risk management Embedding operational risk management: The real use test Use test: the need for banks to demonstrate that risk management processes are truly integrated into the management of the business. The real use test: giving the business a risk framework that they can actually use.

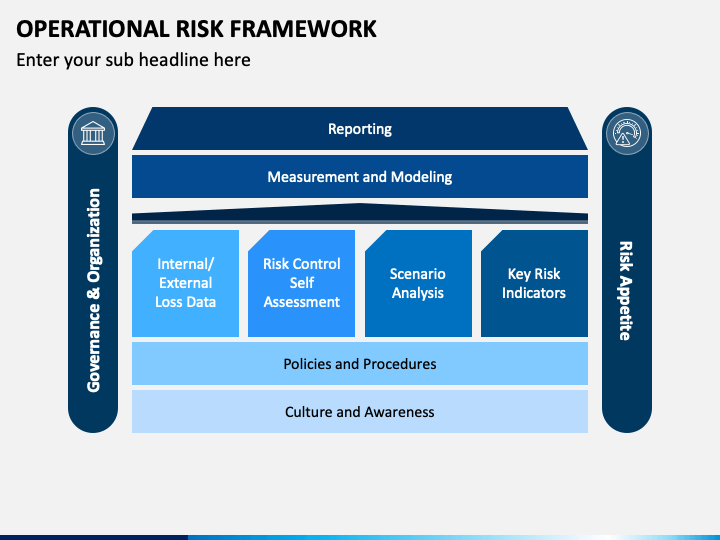

Operational Risk Framework PowerPoint Template PPT Slides

shifted to operational risk after greater initial focus on credit and market risk. An emerging regulatory focus—very much in line with sound day-to-day risk management—is to ensure that the . CCAR loss estimation framework be firmly grounded in the institution's regular operational risk management process.

Operational Risk Management OCEG

Operational Risks: This category contains operational risk, empowerment risk, IT risk, integrity risk, and business reporting risk. Strategic Risks: This category includes competition, customer risk, demographic and cultural risk, innovation risk, capital availability, regulation, and political risk.

Elements For Operational Risk Management Framework PPT Images Gallery PowerPoint Slide Show

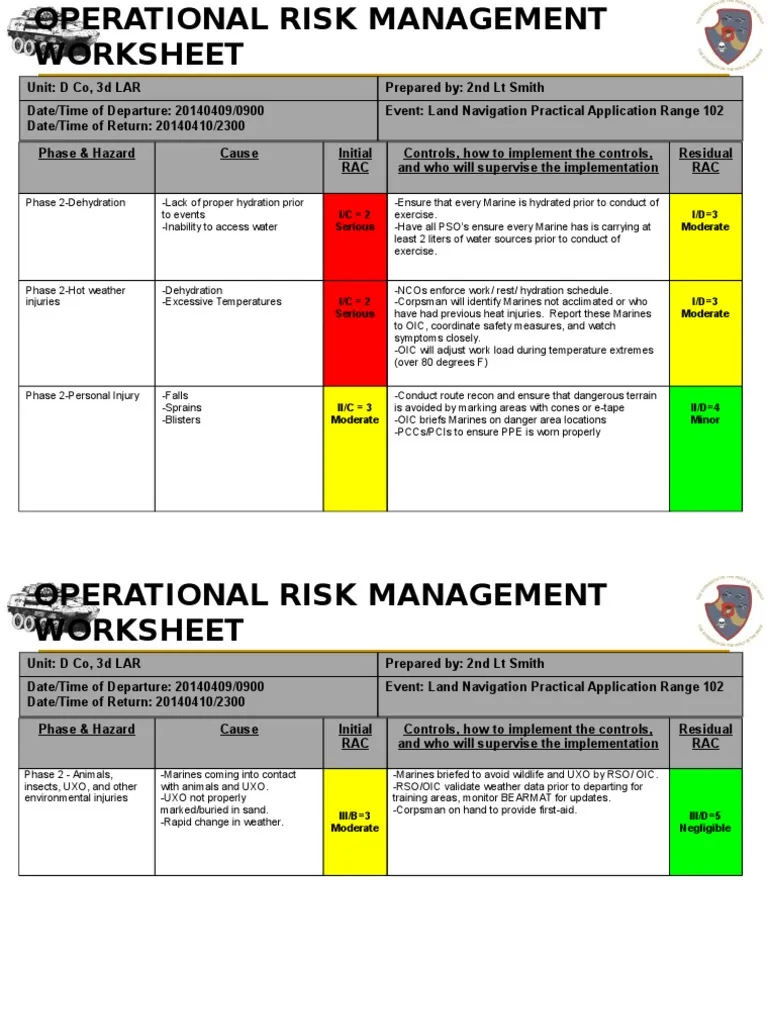

SRM decisions are generally made at the Agency Administrator, Director Level or higher. Operational (Deliberate) Risk Management (ORM): Applies the process displayed in this guide and is completed when there is ample time. ORM relies on clear objectives, and each step should be documented.

Integrating Risk Assessment Into Lifecycle Management TraceSecurity

Transparency of controls. Framework for management process. Adherence to regulatory and legal requirements. Protection of Reputation. Positive influence on rating. Best practice implementation. Service Quality Improvement. Preservation of Capital.

Designing Operational Risk Management (ORM) Framework (PowerPoint) Slideshow View

Project Risk Management Plan Template This template allows you to create a project risk management plan for Excel, which may be helpful for adding any numerical data or calculations. You include typical sections in the template, such as risk identification, analysis and monitoring, roles and responsibilities, and a risk register.

Enterprise Risk Management Framework Download Now

Here's a risk assessment framework template that covers all the stages of project procurement: Project Conceptualization, Project Planning, and Project Implementation. This PPT Template helps you review previous assessments and PRA (procurement risk assessment) of your company. perform internal and external analysis.

Operational Risk Management A comprehensive overview of ORM

2 Overview of the TBS Framework for the Management of Risk 2.1 Key Concepts. Key concepts relating to the management of risk that underlie both the Framework for the Management of Risk and this Guide are outlined below. Risk. Risk is unavoidable and present in virtually every human situation. Public and private sector organizations face risks.

Operational Risk Management Template Risk Management Risk

They represent a collection of operational risk management activities and processes, including the design and implementation of the FRFI's framework for operational risk management. The second line of defence Footnote 3 is best placed to provide specialized reviews related to the FRFI's operational risk management.

Operational Risk Management in Banks

This course will highlight key elements of an Op Risk Management framework and help you identify the appropriate elements to incorporate in your own program. By the end of the course, you will be able to capture, report, and investigate operational risk events, produce meaningful key risk indicator (KRI) data and trend analysis, assess.

The Risk Management Framework

This Operational Risk Management Framework is accomplished through a process that includes governance structure, operational risk identification, assessment, measurement methodologies, policies, procedures, and strategies for mitigating, controlling, monitoring, and reporting operational risks.

Risk Management Definition, Strategies and Processes

Operational Risk Management has increasingly become the most important of the three primary risks (along with Market and Credit Risk) facing corporations, and not just in financial services. Its key sub-disciplines - cyber security, business continuity, fraud (especially internal fraud), vendor management, and IT risks have assumed significant standalone proportions in recent years.